College Financial Crisis: Avoiding Closures & Making Smart Choices in 2025

Choosing a college is about much more than academics, campus culture, or location. Families today should also be asking an important question: Is this school financially stable?

College closures, mergers, and deep budget cuts have made headlines in recent years, leaving many parents and students concerned about what the future might hold. Experts predict that 100's of colleges are at risk of going under.

The good news is that there are tools you can use to evaluate a college’s financial health and help you decide if a specific college the is right financial investment. But first, let's examine why so many colleges are struggling right now.

Why Colleges Are Hurting

Colleges across the U.S. are facing real financial pressures, and 2025 is the first year where several of these issues are colliding and having a dramatic impact.

1. The Demographic Cliff

The number of students graduating from high school is shrinking. After the 2008 recession, families had fewer children. Fast forward 17 years, and in 2025 we’re beginning to feel the effects. Quite simply, there are fewer college-aged students.

2. Declining Belief in the Return on Investment

Some families are questioning whether college is worth the high price tag. As tuition costs rise, some students are choosing less expensive local options, like community college, or skipping college altogether in favor of trade schools, apprenticeships, or direct work opportunities.

3. The Lingering Effects of COVID

When COVID disrupted higher education, many students took gap years, lived at home while attending online classes, or left school altogether. Colleges lost significant tuition and housing revenue, and some have never recovered.

4. The Cost of Staying Competitive

To compete for students, schools spend millions on new dorms, gyms, and student centers. These amenities can attract families in the short term but often come at the cost of long-term debt.

5. Overspending and Weak Financial Management

Some colleges have lived beyond their means, spending heavily without the revenue to back it up, resulting in growing deficits, program cuts, and staff layoffs.

6. Loss of Research Funding

Colleges have been hit with steep federal funding research funding cuts. Many institutions reduced or eliminated Ph.D. programs, further adding to the financial loss. Families may want to consider institutions that rely less on federal research dollars for stability.

7. Endowment Taxes

The federal tax on university endowments has increased. Most private colleges with large endowments will feel a big impact and will be forced to limit funds for student aid, faculty, and facilities. The smaller the endowment, the smaller the tax - colleges with fewer than 3,000 undergraduates are exempt from the tax increase, leaving them with more resources to support students.

8. FAFSA Delays and Confusion

The 2024 FAFSA overhaul caused headaches for families and colleges alike. With delays in aid packages and less clarity around affordability, many students simply chose not to enroll in 2025 - further reducing tuition revenue.

9. Decline in International Student Enrollment

Many colleges are experiencing a noticeable drop in international applications as students choose to study closer to home or in other countries. Since international students pay higher out-of-state rates, this decline represents a significant financial loss for institutions that have long relied on this revenue stream.

It is a very challenging time for higher education, to say the least.

Proceed with Caution . . .

While the headlines may feel unsettling, don’t panic. Families should procced with caution and evaluate each college on their list to determine their financial health. Here are some factors worth considering:

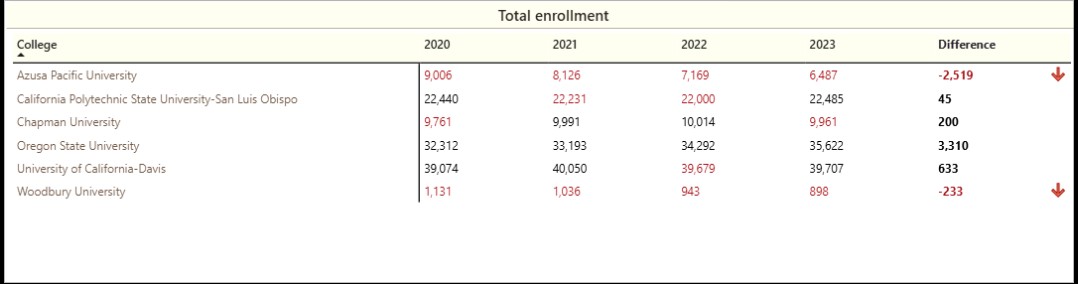

- Enrollment trends: Significant drops in enrollment year after year can have a big impact on a colleges bottom line. With less tuition coming in, school need to find ways to make up for the loss.

- Endowments: Schools with large endowments may be better off, even with the endowment tax. It is worth considering the size of the endowment and the amount dedicated towards each full-time student.

- Funding sources: Public schools have smaller endowments and rely more on state and federal funding. Investigate if there have been recent state or federal cuts in higher education.

- Research funding: Examine how much research funding was cut. R1 tier research schools depend heavily on federal research dollars. Find out if the school is using alternative funding sources to make up for the loss.

- Facilities: Buildings that look worn and not maintained can be an indicator of financial issues. Pay attention to this on a college visit.

- Staff/Major Cuts: Be mindful of any large staff layoffs or reductions to programs/majors.

Options When Building a College List

- Consider alternatives: Schools that avoided fines for campus protests and cuts to research funding may have stronger financial security. Look at colleges that haven't been targeted by the federal government - these are often less selective schools (but still a fantastic education). Many private schools with healthy endowments are able to lean into their funds to combat research cuts. Regional public universities or those not in the spotlight may have more financial stability than those in the news cycle.

- Look at smaller schools: Private colleges with less than 3,000 undergraduates are excempt from the endowment tax increase. Smaller schools also seem to be less of a target.

- Ask questions on visits: Talk to admissions reps about how the school is adapting to budget pressures and drops in enrollment.

Tools to Help Families Assess College Stability

When it comes to evaluating a school’s financial health, families don’t have to rely on guesswork. There are tools that track data points such as enrollment shifts, debt levels, endowment health, and overall financial strength. These resources can highlight red flags, like sliding enrollment or rising expenditures. They can also provide reassurance when a college is managing its finances well.

One tool is Forbes 2025 College Financial Grades, which evaluates more than 900 private colleges on their financial strength. The rankings take into account endowment health, debt levels, expenses, enrollment trends, and other key factors that impact long-term stability. You don't need to be a math whiz to understand the list - the grades make it clear! Forbes is also very transparent about how they evaluate schools and calculate the grades.

Families can use these grades as a warning sign or reassurance when comparing colleges. A strong grade doesn’t guarantee stability, but it shows that a college has healthy finances to weather challenges. A weak grade (C or less) can signal risk, but some schools can bounce back if they take responsible fiscal action. Access the Forbes list HERE for $10 a month or $49 year.

If you are up for a deeper dive and want to analyze data, College Viability is a valuable resource. It tracks real-time data on enrollment shifts, expenditure patterns, and endowment health of private and public colleges. Unlike rankings, this tool helps families spot trends - such as declining student numbers or rising debt - that might indicate a school is struggling. It gives families a fuller picture of how colleges are managing their finances. You can purchase College Viability HERE. There is a $59 fee for the annual report, but the peace of mind is well worth the cost.

Below is a example of the College Viability enrollment trends report. Several schools have minor fluxuations year-to-year, but it is obvious that 2 schools have experienced signficant drops in students enrollment for consecutive years.

Final Thoughts

Colleges are facing significant challenges in 2025, but not all schools are in trouble. Many institutions remain strong, innovative, and financially healthy. By using the resources mentioned above, families can make informed choices and feel confident about the investment they’re making in their student’s future.

Make It U College Consulting offers personalized guidance on college list building, essay strategy, testing plans, application assiance and more!

Book a free consultation with Kris to get started - and

Find Your Path to College with Less Stress, More Success!

Subscribe to the College Insider monthly newletter and blog to receive exclusive tips and advice!

Thank you for subscribing!

Have a great day!